A mechanic’s lien or construction lien is a claim against your property made by a contractor, subcontractor, or material supplier who feels he has not been paid in full. Liens were created to protect contractors and suppliers from not getting paid. The laws governing liens vary from state to state, but in all states a lien against your property is a problem. It creates a “cloud” on the title, making it difficult or impossible for you to get a mortgage or sell the property until the lien is lifted. At worst, you can end up paying for the work twice, once to the general contractor (who never paid his sub, for example) and again to the sub.

Who should sign? A lien waver is a document signed by the contractor, subcontractors, and suppliers stating that they have been paid in full and waive the right to slap a lien on your property. Even though you have paid the general contractor in full, he may fail to pay one of his subs or suppliers, giving them the right to file a lien against your property. As a general rule, it is wise to have the general contractor, key subcontractors, and major suppliers sign lien wavers before handing out the final check.

On a large project, some banks will require lien waivers before each progress payment is made. At a minimum, most will require a lien waiver from the general contractor before cutting the final check. They should also get waivers from key subcontractors and suppliers, but often do not. After all, it’s you on the hook for the lien, not the bank.

A time bomb. Until a title search is done – as when you go to sell the house ten years later – you may not even know that a lien has been filed, as there is no automatic notification in many states. To protect yourself, have your general contractor sign a lien waiver before handing over the final check, whether a bank requires it or not. You can also call the local town hall to see if any liens have been filed. It’s also not a bad idea to contact the subs and major supplier to see if they have been paid before cutting the final check.

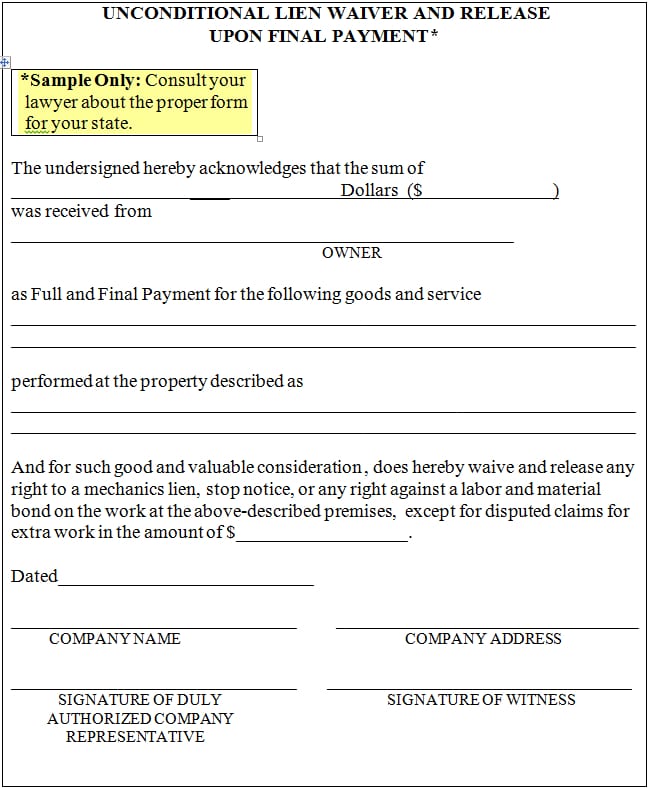

In general, a lien waiver should contain:

- The name and address of the contractor or supplier

- The owner’s name

- The amount of money received

- A detailed description of the work, it’s location, and it’s current status

- Dated signature of the contractor, supplier, or an authorized representative

- Witness signature (good to have)

A lien waver is worded differently depending on whether it is signed along with a progress payment or the final payment, and whether you or your contractor has already paid the bill (an unconditional waver) or are about to pay (a conditional waver). A sample final-payment lien waiver is shown below.

Before making final payment to the general contractor, he should present the owner with final lien waivers from all major subs and suppliers on the job. However, since the laws and specific wording required vary from state to state, consult with a lawyer before proceeding.

CLICK ON FORM TO ENLARGE

See also How to Fight A Mechanic’s Lien

Steve Taylor says

Does Lien Waver from Sub Protect Us From His Suppliers?

We are a general Contractor on a project who has an agreement with a sub-contractor who has purchased materials for our project. The subcontractor has not been paying his material bills and we are worried that his suppliers can put a lien on us. If the sub-contractor has signed a lien waiver with us, are we still susceptible to have a lien placed on us by his material supplier?

buildingadvisor says

My guess is that the lien waiver signed by your sub provides partial protection, but not 100%’

In commercial construction, some contractors get waivers from both their subs and conditional waivers from their subs’ suppliers. Then the prime contractor writes a two-party check (to the sub and supplier) for the sub’s materials. This eliminates most risks of getting stuck with a sub’s unpaid bills.

Also remember that liens follow strict guidelines and deadlines about filing preliminary notices and liens. If these are not followed, the liens are invalid. A local lawyer can fill you in on the procedures you need to follow in your state.

Mark says

Notice of Termination

Is it possible to draft a Notice of Termination and Final Payment Affidavit for a project that is substantially complete (punch list items addressed, CO issued), but stipulates that final exterior grading/landscaping will be completed when weather permits?

buildingadvisor says

Lien law is complicated and full of pitfalls, so I’d suggest you speak with a construction lawyer about this.

From your question, it sounds like you are in Florida, one of the states that requires owners (or their representative) to file a Notice of Commencement at the beginning of most projects. A Notice of Termination can be filed by the owner at the end of a project to reduce their exposure to liens from subcontractors or material suppliers. A Notice of Termination may be required when a mortgage loan is issued or when the contract is terminated.

A Final Payment Affidavit must be filed by the contractor to preserve his right to file a lien. It also protects the owner from subcontractor/supplier liens by warranting that all work is completed and that all subs and suppliers have been paid in full. This protects the owner from having to pay twice for work where the contractor has failed to pay a sub or supplier. The owner should not release the final payment until he receives the Affidavit.

While the parties may agree that your project is “substantially complete,” it has not reached “final completion, which is typically when the Final Payment Affidavit is issued. If all parties are in agreement, perhaps you could structure the final grading and landscaping as a separate contract. Not sure if you can make completion of the landscaping a condition of the Final Payment Affidavit, however. Best to check with a local construction lawyer as to how this might affect the owner’s and contractor’s lien rights.